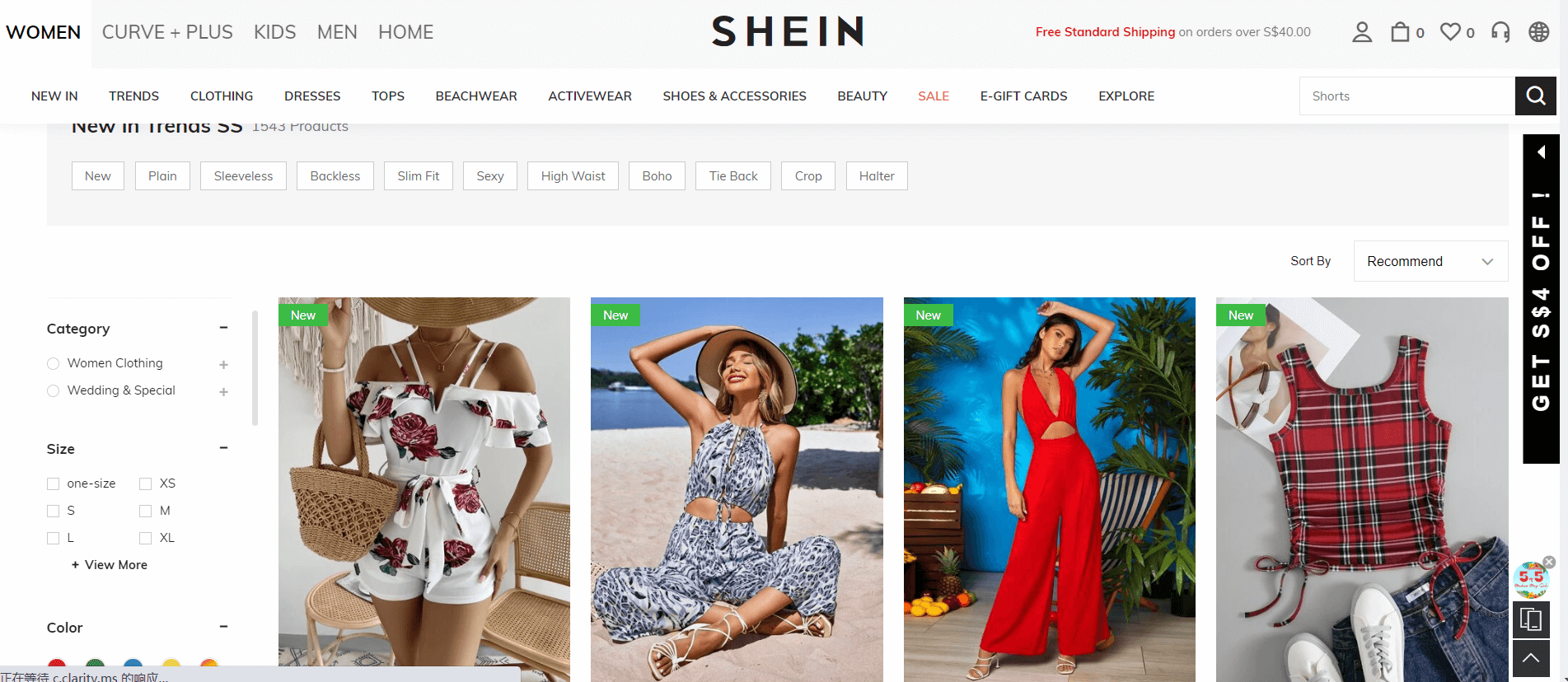

There are only four fashion-related companies on Time magazine’s list of the 100 most powerful companies in the world for 2022. Among these is the name of a Chinese company called Shein. Shein is an impressive, ultra-fast fashion brand, that is headquartered in Nanjing, China, and has taken the European and American markets by storm in recent years.

The global fashion e-commerce upstart currently has annual sales of over 10 billion US dollars, and its software downloads exceed that of the US e-commerce giant Amazon. According to a recent report by Bloomberg, Shein is expected to receive an investment worth $1 billion from the American Pan-Atlantic investment company. With this financial inducement, Shein will be valued at more than $100 billion.

Shein’s success is a rarity, as never before has a Chinese e-commerce company attained such great achievements in the past. The Shein model, which relies on China’s strong manufacturing capacity and perfect supply chain system, has also attracted a large number of followers. These followers are targeting the field of cross-border fast fashion e-commerce, and are gearing up to become the “next Shein”.

Which companies are similar to SHEIN?

According to Vogue Business statistics, there are at least 12 platforms on the market that are similar to Shein in terms of operation model, target market, and marketing methods.

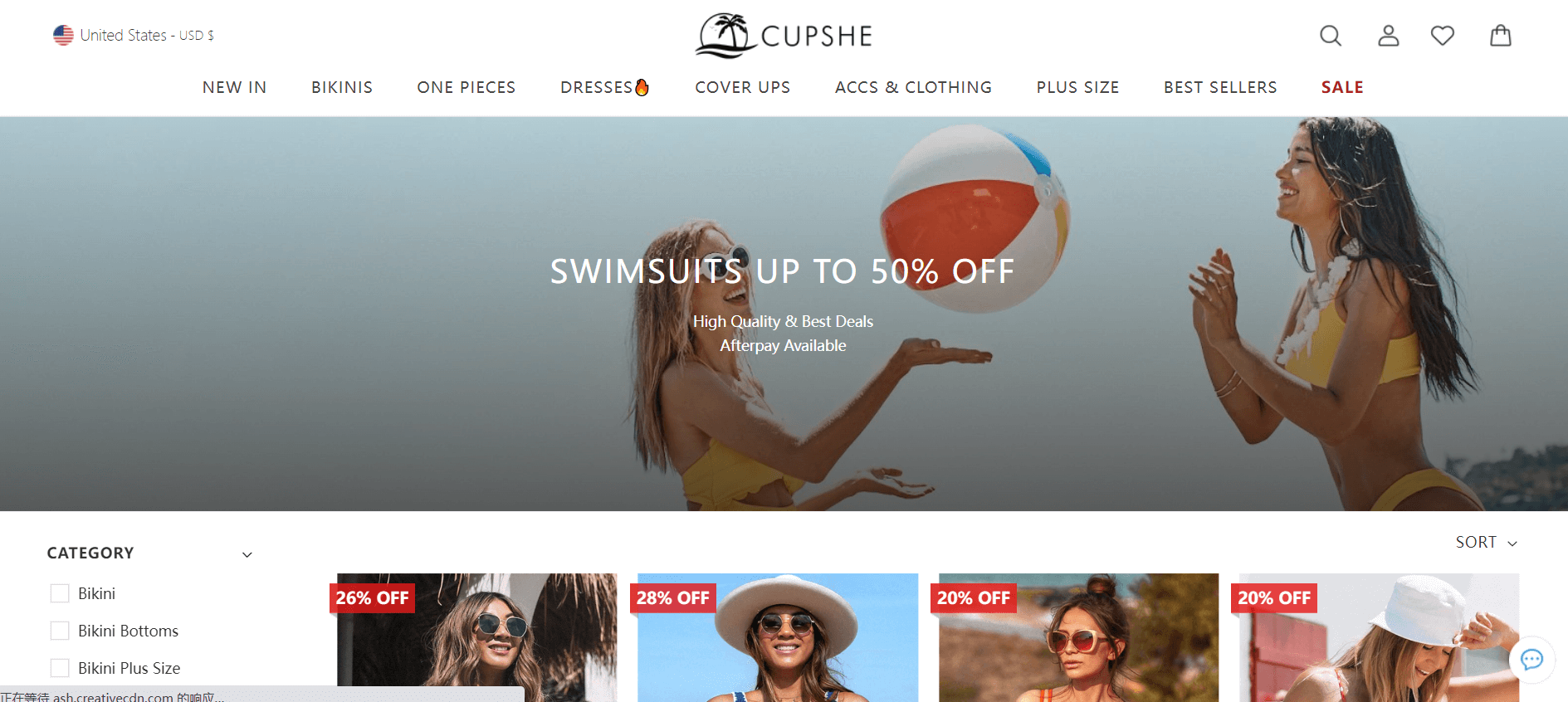

A considerable number of these platforms are established by executives of large groups or direct investment by large groups. For example, in 2021, Jiayu Capital, founded by former Alibaba CEO Wei Zhe, made a strategic investment in Cupshe, a cross-border e-commerce company that focuses on swimwear. The amount of this strategic investment exceeded RMB 100 million. Similar to Shein, this DTC cross-border e-commerce company also comes from Nanjing, China.

According to the Tianyancha App, Cupshe’s parent company is Nanjing Kapexi Network Technology Co., Ltd., which was established in December 2015. The company is mainly engaged in the cross-border e-commerce business and faces the European and American markets.

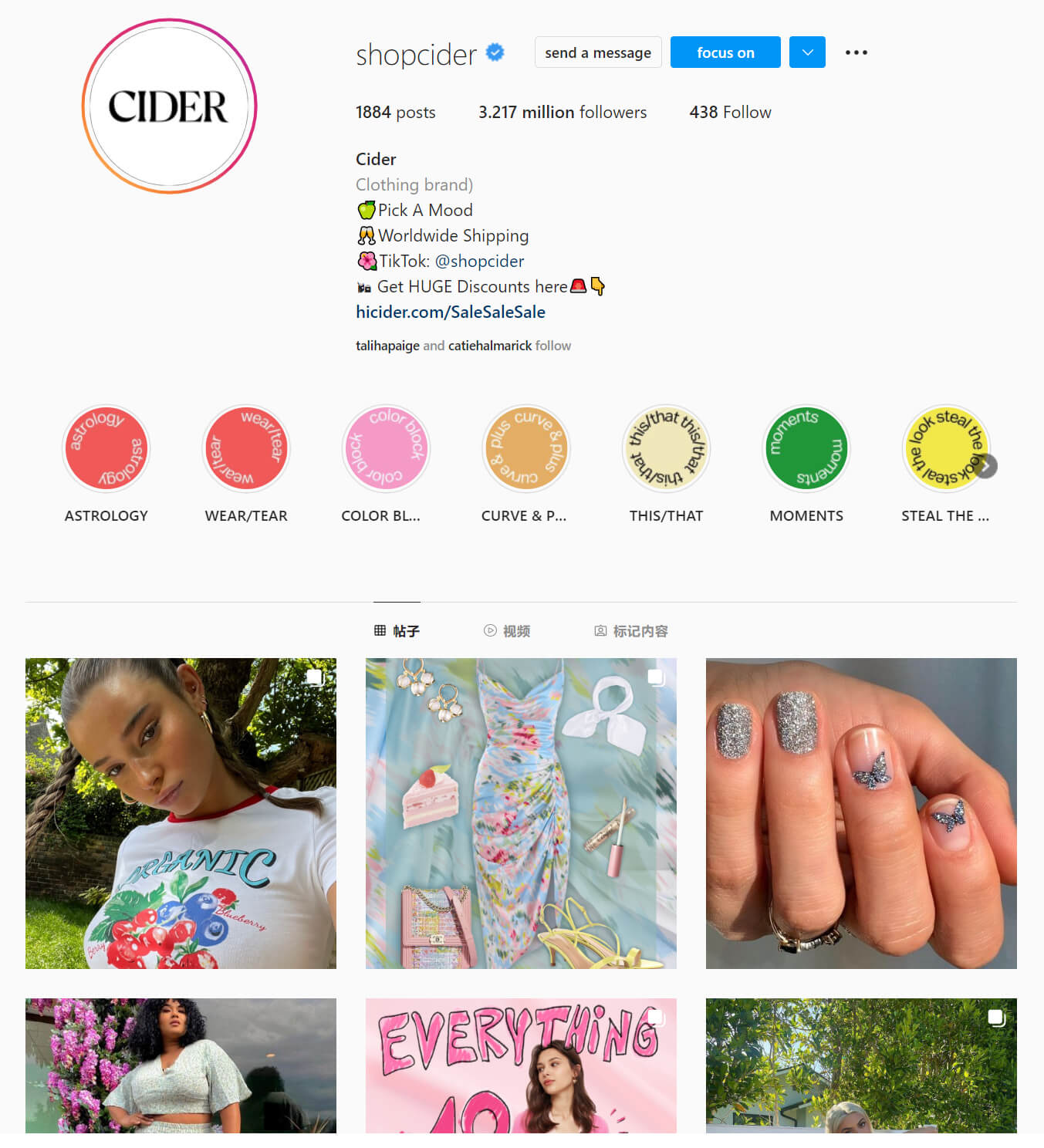

Cider

Cider, which currently has the most momentum, was founded by Wang Chen, the co-founder of the clothing rental platform YCLOSET. The company has completed 4 rounds of financing within its first year of existence. They have been favoured by large investment institutions such as DST Global, IDG Capital, Greenoaks Capital, and other international venture capital institutions that focus on Internet companies. It is worth mentioning that Cider is currently valued at more than $1 billion.

Another cross-border fast fashion e-commerce company Infinite Waves from Beijing has received investment from ByteDance and Sequoia Capital. According to the information disclosed on its official website, most of the company’s members are from leading Internet companies such as ByteDance. The size of the company displayed on zhipin.com is between 100 and 499 employees. At present, they are recruiting Tiktok planners, car editors, and other positions related to overseas social media marketing and clothing design. However, no e-commerce website platform related to Infinite Waves has been found yet.

There are also some fast fashion e-commerce companies targeting overseas markets other than Europe and the United States. For example, Urbanic from Hangzhou focuses on the Indian market. The company has completed 3 rounds of financing and received a US$10 million A+ round of financing from FOSUN RZ Capital, a venture capital platform of Fosun Group.

Founded in 2012, Jolly Chic is mainly aimed at the Middle Eastern market. The platform has more than 800,000 followers on Instagram. The sales categories are mainly women’s clothing and offer accessories, home, mother and baby, and skincare products.

In addition, companies like Globalegrow E-Commerce and CHICV adopt a multi-platform strategy.

CHICV owns independent sites such as StyleWe, Just Fashion Now, and Noracora. Among the three fast fashion cross-border e-commerce platforms, StyleWe and JustFashionNow are similar in that they focus on “independent designer originals”, while Noracora focuses on fast fashion. Despite this, the items sold on all three platforms are very similar, with the same unit price and core categories. In addition, all three platforms mainly focus on affordable, low-cost women’s clothing. CHICV received a $50 million Series B round led by Tencent in April last year.

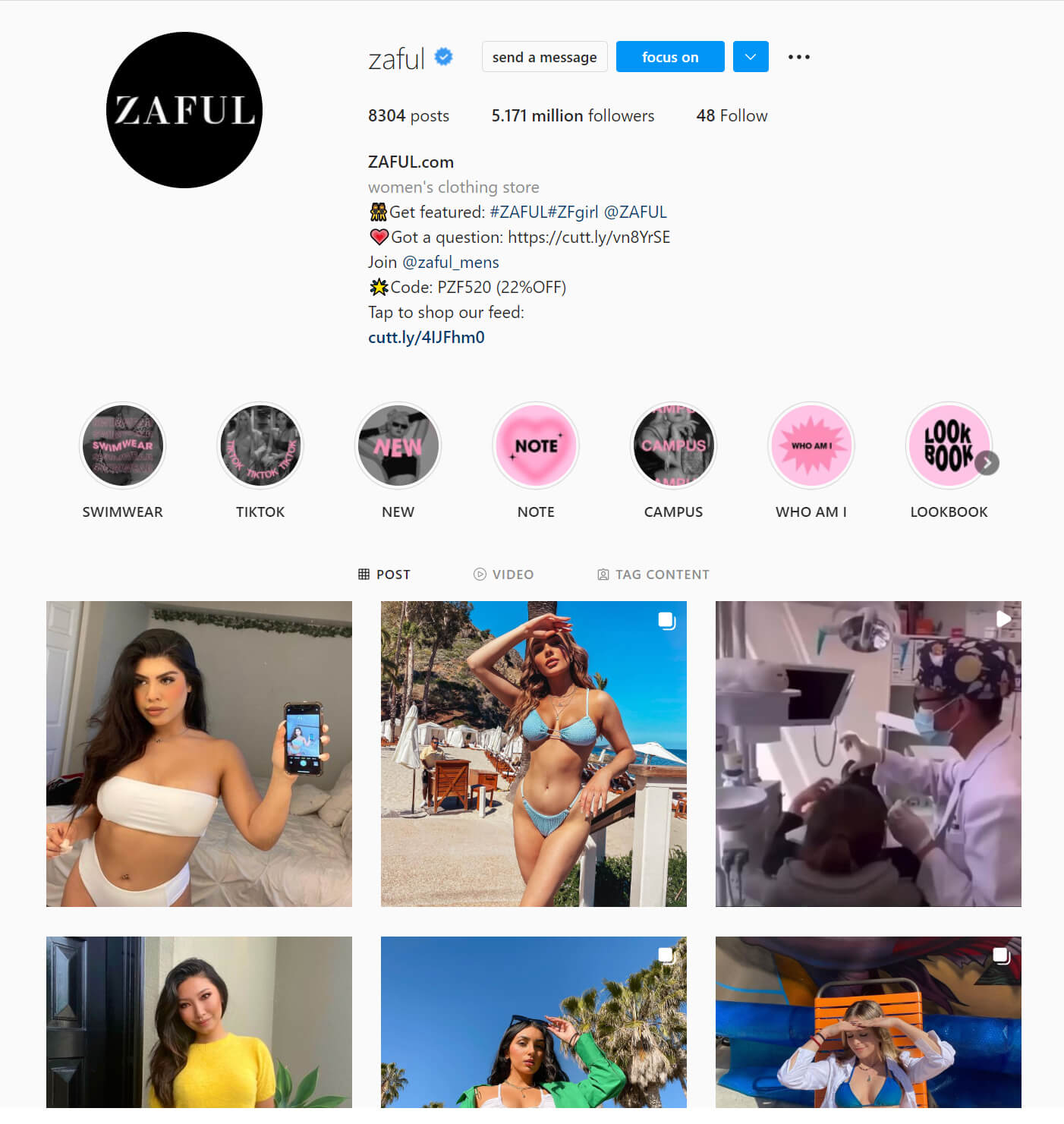

Globalegrow E-Commerce owns brands such as Zaful and Rosegal, of which Zaful has been shortlisted for the “BrandZ Top 50 Chinese Overseas Brands” for four consecutive years since 2018.

Why Shein become their target?

Compared to the other platforms mentioned, Shein is the earliest established company. Shein was founded in Nanjing in 2008 by Xu Yangtian. But Shein didn’t have the supply chain and market advantages it has today. In fact, Shein’s early business scope was limited to wedding dresses. It was not until the start of 2012 that Xu Yangcai decided to give up on the wedding dress business and switch to the cross-border women’s clothing business. In 2015, the platform name was changed from “Sheinside” to “Shein”.

Today’s Shein has surpassed the parent company of fast-fashion giant Zara in valuation and market share. But once upon a time, it wanted to become the “online version of Zara.” Shein is not alone in this regard, Beijing Full Speed Technology Co., Ltd, which was established in 2021, also positions itself as the “Chinese version of Zara”.

In their effort to become Zara, only Shein made it to Zara’s level and actually surpassed Zara and thus became a new target to be followed. For now, Shein’s success in conquering the global market takes place against a backdrop of unprecedented challenges for the global fashion industry i.e. the trade war and the new crown epidemic have affected overseas consumption habits and preferences.

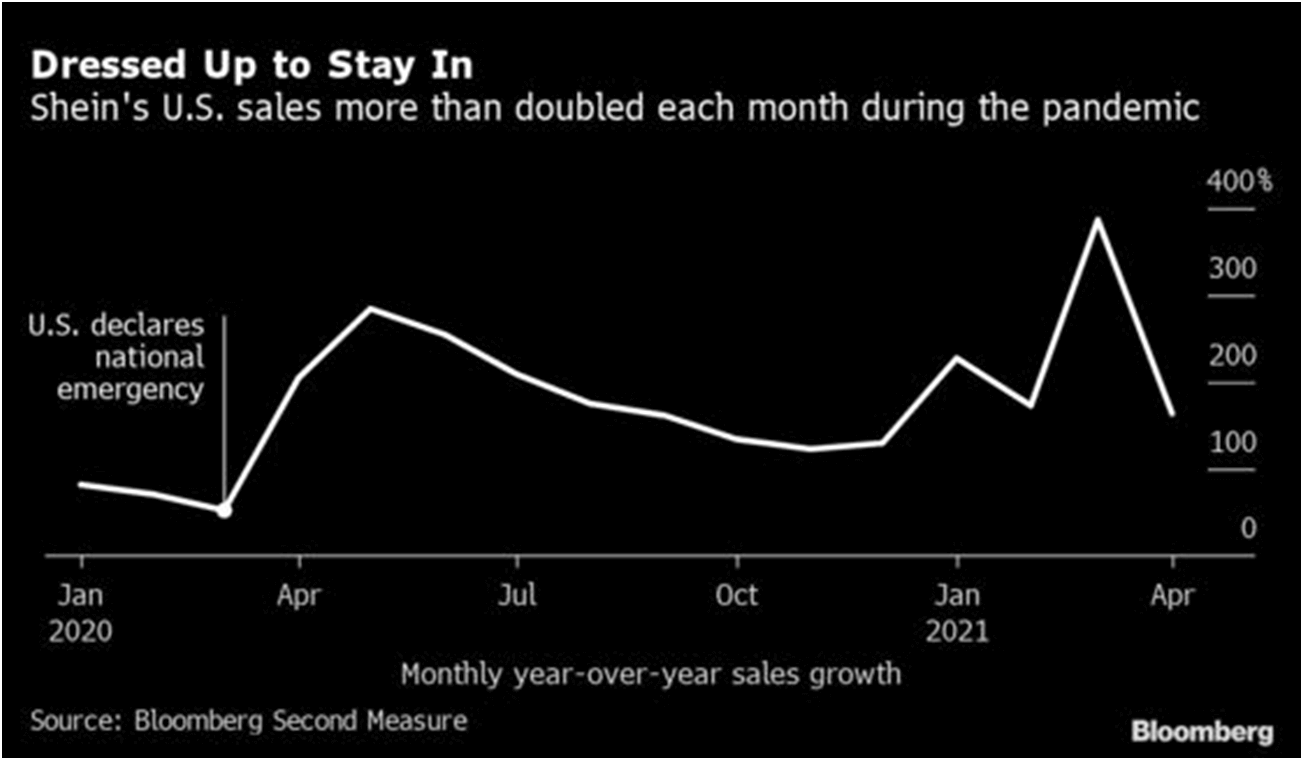

But these challenges turned into opportunities for Shein. According to Euromonitor International, the rapid take-off of Shein’s sales came just after 2019. The company’s sales in 2020 were more than double those of 2019, making it the world’s largest e-commerce fashion brand at the time.

A report by Bloomberg also pointed out that during the China-US Trade, China introduced tax relief policies for cross-border e-commerce, which greatly reduced costs. In addition, thanks to Shein’s direct sales to consumers and cheap prices, most packages sent to consumers avoided U.S. taxes.

But Shein’s biggest advantage is that it has an efficient and flexible supply chain. The entire processing cycle: from garments to delivery can take just 7 days, while the same type of fast fashion e-commerce, such as ASOS, needs at least 2 weeks to process. According to the “LatePost” report, Shein’s new volume in one to two months has caught up with Zara’s new volume throughout the year.

In addition to the supply chain, Shein’s algorithm is comparable to Tiktok’s algorithm. The advantage of its algorithm lies in the instant response between the same supply chain. Thanks to Shein’s sophisticated algorithm, it has mastered the method of predicting trends. The algorithm allows the platform to quickly track and analyze users’ browsing activities, click preferences, and other behavioural information to quickly predict the style that will go viral and instantly put it into production. By doing so, the company never runs into problems with its inventory.

It is precise because of this flexible demand that small workshop-style garment factories in Guangzhou and other places have become Shein’s closest partners. According to the “First Financial” report, these small manufacturers that are partnered with Shein, have installed Shein’s supply chain management system. By utilizing this system, the workers in charge of production only have to check the specific production tasks and times on the system.

Another essential part of Shein’s success is the early deployment of overseas localized marketing and the adoption of online celebrity marketing strategies. It is reported that as early as around 2010, the platform started to cooperate with KOLs on Instagram and YouTube. The brand also uses TikTok for promotion. Currently, platforms such as Cider, Zaful, AllyLikes, etc. have adopted similar approaches to increase user growth.

Who is the most advantageous among those “Shein-like” brands?

Looking at various indicators such as financing scale, social media influence, development momentum, and user traffic growth, Cider and Zaful are undoubtedly the two strongest candidates among the current contenders.

According to Sensor Tower, Cider had 300,000 total downloads worldwide in March, while Zaful’s global download total is 100,000. By comparison, Fashion Nova, a British fast-fashion platform with global reach, had a total of 400,000 global downloads in February.

Cider currently has 62,000 followers on TikTok and 3 million followers on Instagram. Searching for Cider Haul-related keywords on YouTube produces several videos and the most viewed videos have around 1 million views.

The social media influence of Zaful is significantly higher than that of Cider. It has 347,000 followers on TikTok and 5 million followers on Instagram. Moreover, Zaful has also opened separate Instagram accounts for Portugal, France, Italy, Japan, the Philippines, Spain, Germany, and other markets. And Zaful Haul-related YouTube views are on a scale that Cider has yet to reach — the two most viewed videos have both surpassed 10 million views.

Although both Cider and Zaful are trying to get as close to Shein as possible in terms of marketing methods and supply chain management, they all adopt the same KOL strategy, relying on users’ unboxing videos to gain influence and sign contracts with influencers. But they also came out with a different strategy.

Cider is currently nurturing a brand community. On Instagram, Cider’s other account, Cidergang, is dedicated to loyal users and has nearly 50,000 followers. Cidergang also has a dedicated group on Discord, the social platform for Generation Z fans, which already has nearly 3,000 members.

Zaful is also running a community for Generation Z. In addition to this, it also actively participates in industry events and fashion weeks. Zaful has walked or presented its clothing at New York Fashion Week and London Fashion Week, and hosted events such as the Sustainable Fashion Forum.

The remaining brands such as AllyLikes, although still in its infancy, has huge platform support. They can directly enjoy Alibaba’s cross-border logistics, channels, and operational advantages. For example, Urbanic has taken a different approach, focusing on overseas markets such as India, Mexico, and Brazil outside the mainstream markets such as the United States and Europe. Urbanic has surpassed 800,000 Instagram followers in India. Its Brazilian market has 1.7 million Instagram followers. But Mexico is still in its infancy, with just 30,000 followers.

In addition, some platforms that started from sub-categories, such as Cupshe, which started from swimwear, and PatPat, which started from children’s clothing, are also worthy of attention as the market size of these two sub-categories has also increased in recent years.

According to the research data produced by the data agency Statista, the global swimwear market size has reached 22.71 billion US dollars in 2021. And that size is expected to grow to $29.1 billion in 2025. Market research firm NPD has released a report that the epidemic is also a major opportunity to promote the development of swimwear. The revival of beach travel is fueled by post-pandemic consumer escapism.

Children’s clothing is a larger market space than swimwear. According to data from Grand View Research, the global children’s clothing market has reached 197.2 billion US dollars in 2019 and is expected to exceed 280 billion in 2025.

The emergence of the “Shein Model” has provided most companies with a successful template that can be quickly replicated. On the road to becoming Shein, the competition is also increasing. Especially when Shein has developed to the scale of hundreds of billions of dollars today, it is getting more and more out of reach to surpass Shein.

However, this path is not without new opportunities. The success of Cupshe and PatPat in swimwear and childrenswear means that there is still hope for the Nuggets in the market segment. The paths of Urbanic and JollyChic targeting emerging markets are also worth learning from. Especially with the growing number of mobile Internet users in emerging markets such as Southeast Asia and Latin America, these two regions with many young consumers may become new target markets for fast fashion e-commerce.